Search Options Trading Mastery:

- Home

- Advanced Strategies

- Straddle Options Strategies

More Straddle Options Strategies

Straddle options strategies are one of my favourite option trading strategies. This article is a followup to our previous one in the straddle options series. So far, we have explained what the straddle option is and the most popular chart patterns to look for to time your entry - these being triangle patterns.

However, from personal experience I have found that triangle patterns do not always precede price breakouts - and when the price doesn't go anywhere, your option positions will lose value.

So the challenge is to find a system whereby we feel pretty confident that once we take a straddle position, the price will have a high probability of moving significantly within a short time period.

As far as straddle options strategies go, I think the following system works very well.

Before we get into specifics, you will need to know something about these two concepts:- (1) Elliott Wave Theory and (2) Fibonacci Retracements.

If you don't know anything about these, you can:

Read about Elliott Wave Theory here

Read about Fibonacci Retracements here

If you're happy that you have at least some idea of the above two, then let's proceed . . .

The reason we want to identify where our underlying financial asset (stock, ETF etc.) is according to Elliot Wave patterns, is so that we have some idea about whether Wave 3 or Wave 5 is about to begin. Wave 3 is normally the longest of the 5 waves and for straddle traders, this means price movement - and price movement in either direction means profit.

Once we have identified which Wave we are likely to be in, our next step is to apply fibonacci retracement levels to ascertain where price resistance levels (likely turning points) will be.

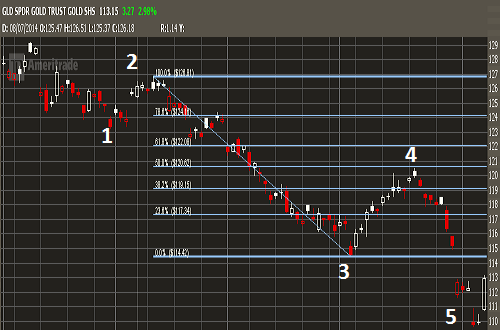

Take a look at the GLD (Gold ETF) chart below:

You'll notice we've identified the 5 Elliot Wave points on the chart and then added Fibonacci Retracement levels to points 2-3-4. You could've done the same with Wave 1 retracing back to Wave 2 but the one you see better serves our purpose.

Point 4 is a 50% retracement from points 2 - 3. This is where you would enter your straddle options position. You want option contracts with at least 90 days before expiration, giving you plenty of time for the underlying to move.

And move it does!

In just 11 days, the price of the Gold ETF fund fell from the 121 level down to 110. That's more than a $10 price move! During this time the value of the put options would increase to such an extent that they would overshadow the loss on the call options and produce a nice overall profit.

Now it's possible that the price level may have increased to the 61.8% retracement level at 122 before reversing, but all this means is that your straddle play would've taken a little longer to realize a profit.

You could've just taken a long put position in the expectation of the price continuing south, but the appeal of straddle options strategies like this, is that you have greater peace of mind and are "covered" in case some news release suddenly changes things.

This is unlikely if you've chosen an underlying such as an ETF that follows the gold price or major index, but if you're doing this on a single company stock, anything can happen without notice.

The Best Stocks for Straddle Options Strategies

You want to choose an underlying stock that, when you look at its price chart, you can see that it doesn't stay still for long. This is not hard to determine if you view at least one year's worth of price data.

The only thing you need to be aware of before putting on your straddle, is that the implied volatility in one of the postiions, is not skewed too much in favour of either call or put options. Any reputable broker will provide this information.

In the case of our Gold chart above, if the market is anticipating an impending fall in the gold price, then it's possible that the gold put options may be over priced. In such cases, you would not use straddle options strategies like this here and look for another underlying asset to trade.

Straddle Options Strategies Alternative

Using the above entry criteria, you may like to consider an alternative that works exactly like the straddle, only it's much cheaper to enter this type of position than buying straddles. They're also more flexible and carry less risk. These nice little setups are called Victory Spreads.

**************** ****************

Return to Option Trading Strategies Contents Page

Go to Option Trading Homepage

New! Comments

Have your say about what you just read! Leave me a comment in the box below.