Search Options Trading Mastery:

- Home

- Option Trading Systems

- Wealth Building Options Trading

Wealth Building Options Trading

A Wealth Building Options Trading Strategy Using Put Options and Averaging Down Techniques

We'd like to explore a wealth building options trading strategy here, involving the use of put options, in conjunction with your share purchases. You may have heard of a stock portfolio building strategy commonly known as "dollar cost averaging" - well this is better than that. It's also much more effective in the long run than simply placing stop losses on share purchases, if you're a trader.

Buying put options provides a form of insurance on stocks you own from a fall in price. You pay a premium of course, in much the same way as you buy insurance on any other significant asset such as a home, and this cost must be offset against the benefit you receive should you need to make a "claim" on your "insurance policy". But the benefits are well worthwhile, particularly in view of what I am about to reveal.

But first, let's set a couple of parameters for our wealth building options trading strategy.

Dollar Cost Averaging - How it Works

Dollar cost averaging is a share purchasing strategy which, over time, is designed to lower the average cost of your overall portfolio of a given stock.

For example, you might buy $10,000 worth of XYZ shares when it is trading at $20. The price subsequently falls to $18 and you purchase another $10,000 worth of XYZ. At $18 you'll be able to purchase more shares for your $10k than you could when the price was trading at $20 - another 55 shares to be exact.

So you now own 1,055 shares but at an average cost of $18.94 ($20,000 / 1,055).

So you repeat this process regularly, with whichever regular investment amount you have chosen. The idea is that, in the longer term, the average cost of your portfolio will be less than the current market value of the share price.

If you have observed the price patterns of this stock on a weekly chart and bought when the price is especially cheap, you will do even better.

This strategy allows you to either grow your wealth over time, or take a profit after having received the benefit of dividend income in the meanwhile - and move on to another company.

Put Options a Better Alternative

If you have enough capital to invest in shares and your focus is wealth building, using option contracts can make a significant difference to your portfolio value over time. It will not only protect you from losses should the stock price fall, but using this strategy will also increase the ultimate number of shares of a given stock that you own, without you having to put in any more money in than your original investment.

Follow this example with me:

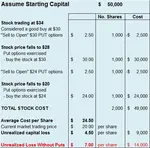

Let's say you have $100,000 to invest in the stock market. You purchase 5,000 shares in XYZ trading at $20 per share.

To insure 5,000 shares against loss in market value, you will need 50 put option contracts.

So you also purchase 50 put option contracts expiring next month, at a strike price of $19.50. You'll notice there is a 50 cents difference here, which means you are prepared to accept a risk of 50 cents times 5,000 or $2,500 (2.5%) paper loss on your $100,000 investment.

Alternatively, using the options delta, you may use it to calculate how many options you will purchase at a lower 'out of the money' and therefore, cheaper, strike price, so that your shares are covered against loss.

If the share price rises before options expiration date, you will make a gain on the shares, which will more than cover the cost of the put options. This is because options pricing works differently to price movements in stocks.

But say some bad news came out next day and the share price plummets to say $15. Without put options you would now be looking at an unrealized loss "on paper" of $25,000 (5000 x $5).

However, at option expiration date your $19.50 put options would now be worth $4.50 x 5,000 which is $22,500.

So here's what you can do. You sell your put options for a large profit and USE THAT MONEY to BUY MORE SHARES of the same stock, except that now you're buying them at only $15 market price.

With your $22,000 profit from the put options, you can now buy 1,465 more shares. You now own 6,465 shares in XYZ but now at an average cost of $18.85 per share, instead of the original $20/share - without outlaying any more capital.

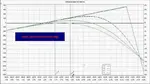

Can you see what you have done here? You have not only lowered your average share entry price, but now own more shares in the process. Your wealth is increasing along with the volume of shares you own. This is how this wealth building options trading strategy works.

Now you just keep repeating this, month after month.

Using this strategy, in an extreme case you could have even purchased your original shares at the very peak of an uptrend before a price crash and yet, over time, once the share price returns to this original level, your portfolio will be worth many thousands more than if you had only relied on dollar cost averaging.

You can also do this using Exchange Traded Fund shares linked to stock indexes, instead of ordinary company shares. They always return to their original price, over time.

Options are the only derivative that you can do this with.

Short CFD (outside the USA) and futures positions have a different pricing model which includes unlimited risk to the upside, which will offset any potential profits from share price rises. While they are a perfect hedging instrument, for wealth building options trading is the only way.

If you would like to know more about this strategy, see actual examples and have all your questions answered, we recommend a series of downloadable videos called the Trading Pro System which, although primarily focused on a safe and proven option trading system that brings in a regular monthly income, also includes a series of bonus videos (module 11) which walk you through a specific example of this wealth building options trading strategy in great detail.

**************** ****************

Return to Option Trading Systems Contents Page

Go to Option Trading Homepage

New! Comments

Have your say about what you just read! Leave me a comment in the box below.