Search Options Trading Mastery:

- Home

- Option Spread Trading

- Advantages of Credit Spreads

The Distinct Advantage Credit Spreads Can Deliver

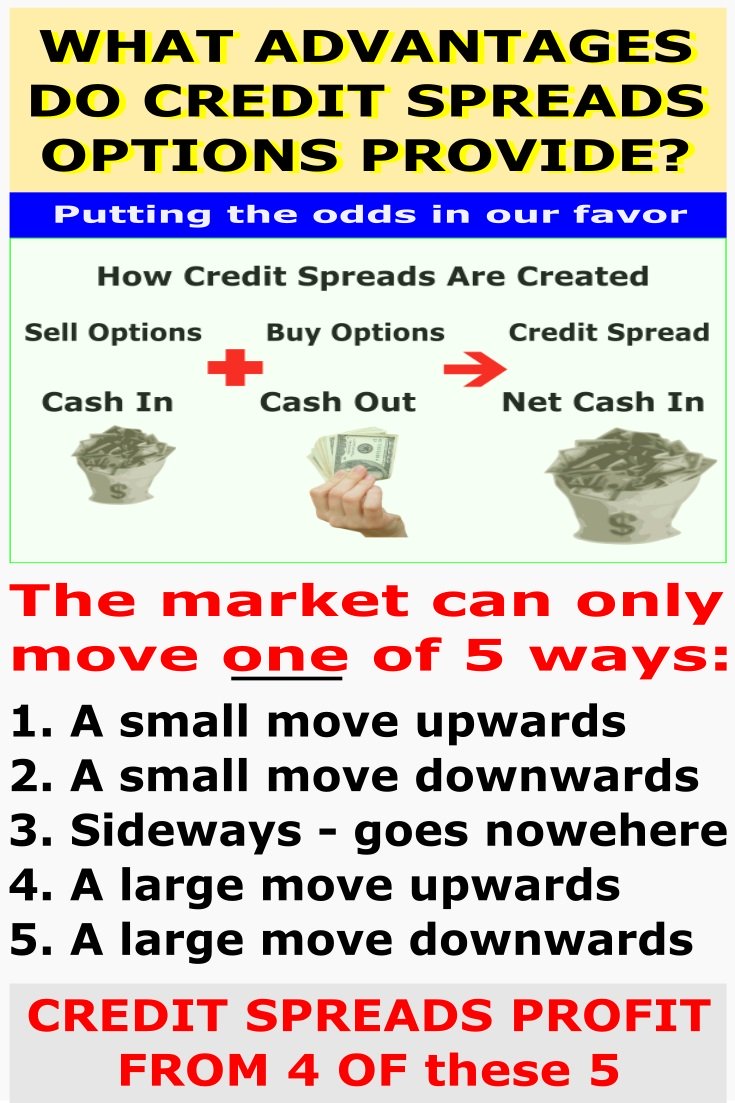

Did you know that there is a distinct advantage credit spreads provide the options trader, over long calls or puts, or even debit spreads? When your credit spread is in trouble there is a concept called 'rolling out' and this singular strategy is what makes credit spread trading so attractive.

But there is a danger . . . If you know what it is, then you can make sure you avoid it.

Let's take an imaginary scenario. Today, we're looking at a stock currently trading at $19.97. So we have sold a credit spread comprised of put options (called a "Bull Put Spread") that expire next month - about 5 weeks away.

We do this on an underlying stock whose price we expect to rise and therefore move away (i.e. upwards) from our spread strike prices, or at least remain around the current level by option expiration date. But during that time, to our surprise, the underlying stock price takes a dive instead.

We originally took out a bull put spread when the stock was trading at $19.97. Our spread involved selling a $19.50 put option and buying the same number of put option contracts at the $18.50 strike price. We receive a credit to our account, of 31 cents per contract.

But the stock price dropped down to $19.35 two weeks into the trade, and stayed there until the expiration date. This is a significant fall in the stock price in only 2 weeks, but it does happen, so we need to know how to react when it does.

There’s no point making lots of money time and time again if we have to give it back again. So what should we do now?

The One Big Advantage Credit Spreads Give the Options Trader

It’s only when there is no 'time value' in our options that we are at risk of being exercised. All we need to do is calculate our 'time value' and we can easily avoid being exercised.

Now, let’s say time goes on and a few days before expiration, the price of our underlying is still $19.35. What do we do then?

Let’s assume the time value left in the bought $18.50 option is very small, because it is "out of the money" and we have concluded we need to do something.

We have a couple of choices...

Rolling Out - Advantage Credit Spreads

The easiest, and most common one that we do, is simply to ‘roll out’ our insurance.

In stock options language ‘Rolling out’ - means to extend the option expiration date, with the same exercise price, to the next month. What we do is buy back our "sold" option, then sell another one for the following month, at the same exercise price. This is one major advantage credit spreads give us.

If we think the stock price is good value at $19.50, and we think it will recover to above that price soon (from its current position of $19.35), then we can ‘roll out’ to the following month and keep the same exercise price.

Rolling out to take advantage credit spreads allow us, is easiest to understand if we look at it like two different steps.

First, we close our current position by buying back our sold puts and selling our bought puts (if they are worth anything).

Second, let’s assume we decide to re-open a new position in the same stock at the same prices, just for the following month.

This is what we call "Rolling Out", and if the stock price is only just below our exercise price, then we would normally do exactly that.

If we do decide to Roll Out, here's what happens:

We buy back our $19.50 put for 17c, which would have expired at the end of September, and we sell another $19.50 put option, which now expires in October, for a higher price (since it has more 'time value' and also more 'intrinsic value' now because the current market price of the share has also dropped). Let’s say we get 32 cents for each option.

We also buy put options out to October, again at the same lower level of $18.50, which will cost around 10c or so (because the share price is higher than this strike price and therefore the put option is still 'out of the money' - so only 'time value' remains)

The above methods demonstrate the advantage credit spreads give us in the reverse situation as well, where we have a "Bear CALL option credit" spread in place (which we enter if we expect the stock price to fall or remain about the same in a short time frame).

If you're convinced there is a good safe living from the stock market to be made using this strategy, you may wish to extend the advantage credit spreads provide, into the popular Iron Condor.

This is a range trading strategy which gives you twice the income that a credit spread does but only risking margin on one side. When you master the art of adjusting these, you open the way to consistent monthly profits.

***************** *****************

Return to Option Spread Trading Contents Page

Go to Options Trading homepage

New! Comments

Have your say about what you just read! Leave me a comment in the box below.