Search Options Trading Mastery:

- Home

- Option Spread Trading

- Iron Condor Option Strategy

Iron Condor Option Strategy

The Iron Condor option strategy and butterfly spreads are very sensitive to volatility. What this means for the trader is, that if you're trying to leg in to your position, the volatility in the underlying market may make it difficult for the other side to get filled.

If you don't get filled on one side of the iron condor, for whatever reason, such as the market moving in the wrong direction while you're waiting for your trade to be filled, my advice is "don't chase it".

What I mean by that is, don't keep reducing the amount of the credit you're prepared to accept, because if you do, your risk graph will suddenly not look so appealing anymore.

Here's what you can do.

If you can't get the price you want for the other leg, you can buy one futures contract - this is the equivalent of adding 100 long deltas to your position.

So let's imagine that you're employing an iron condor option strategy on the Russell 2000 index and your approach has been to "leg in" to it. You have been successful for the call "leg" but can't get the price you want for the put side.

Being a credit spread, the call side would be short deltas, but by adding one long futures contract, you immediately gain 100 deltas, thus helping to neutralise the position temporarily.

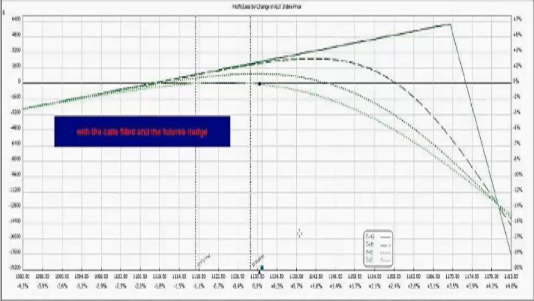

Your risk graph would now look like the one below:

It may not look like the best risk graph but that's not the point. What you have done here, is to give yourself time to get a better price on your put credit spread and you've also bought yourself some time in case you don't get filled that day.

You also have time to re-evaluate your contract sizes and strike prices while you wait for the underlying to come back to a place where you can get filled for the price you want.

The key here, is that it helps you avoid chasing prices.

The other advantage with using a futures contract, is that they can be placed after normal trading hours. This means that should your put side (in our example above) not be filled on the trading day, you can hedge your risk after hours.

For any iron condor option strategy, ideally, you want your deltas to be 20 percent or less, of your theta.

Adjusting Your Iron Condor Option Strategy

Once your Iron Condor is established, consider using a "gear", so that you don't have to move the credit spreads up and down when they are threatened.

Adjusting your credit spreads leaves you exposed to slippage, particularly if your positions involve a large number of contracts. But there is a way that you can control your risk with a small number of contracts.

Let's say you were in the early days of a trade involving 20 contracts on each side of your iron condor option strategy but are now concerned about the upside of this trade because the underlying has moved north.

You could place a debit spread of just 2 contracts at strike prices within the upper boundary of your risk graph. This will immediately neutralise the delta exposure without taking anything significant from your theta (theta is where you make your profit).

Your risk graph would now look like this:

As time progresses, you can choose to increase or decrease the level of your "gear" to balance your position. You can also do the same on the put side of your trade, if this is threatened.

Using "gears" allows you to use small position sizes to neutralize your delta exposure without having to roll up or down your original large credit spreads.

An Iron Condor Option Strategy with Zero Risk

Recently, I found this very interesting video which demonstrates what you can do, to "leg" your way into a no-risk iron condor position in the DIA (Dow Jones ETF).

In terms of timing, you'll need to pay attention to implied volatility in the options, as well as the difference in strike prices for your positions. But I think you'll find it very interesting.

Go back to Iron Condor page, or ...

**************** ****************

Return to Option Spread Trading Contents Page

Go to Option Trading Homepage

Add a Comment

We and other readers of this information site value your input.

You can also (optionally) include any graphics such as charts, if you wish.

New! Comments

Have your say about what you just read! Leave me a comment in the box below.