Search Options Trading Mastery:

- Home

- Advanced Strategies

- Long Condor Spread

Long Condor Spread

The Long Condor Spread - High Reward to Risk Potential

They come up with some interesting names when it comes to option trading strategies. The Long Condor Spread is a setup that is attractive because, although you pay a bit more in brokerage, the risk to reward potential can be quite outstanding.

You might say the long condor is a cousin to its more popular Iron Condor, the difference being that whereas the Iron Condor is a combination of call and put options, the Long Condor involves only calls or only puts, as the case may be.

How to set up a Long Condor Option Strategy

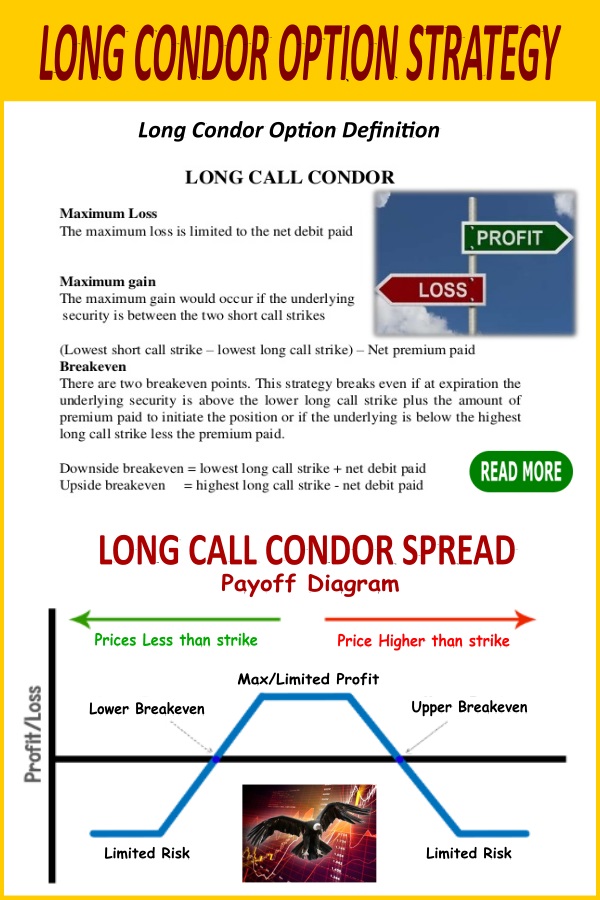

The long condor option strategy is a combination of 4 option contracts, all the same type (calls or puts) and expiration date, but with a spread of different strike prices encompassing a price range.

The idea is that, of the four strike prices, the two middle ones are 'sold' positions, while the two outer ones are bought positions. The formation therefore has a 'body' (sold positions) and 'wings' - like a bird.

Because the sold positions cover two separate strike prices, the body is larger, so a condor, being a large prehistoric bird, seems to have been adapted for the description. It was a bird of prey and in this case, the 'prey' is profit.

The best time to enter a long condor spread is when you believe that the underlying stock is due for a reversal, but not a large reverse. It is designed to be a range trading strategy, so you only want the stock to retrace back within the parameters of your four strike prices. You would structure your trade around the current market price of the share.

Example:

Let's say the current price of XYZ is around $87 and you believe that $90 is a strong resistance level. This is what you could do.

Buy 1 'deep in the money' call option at $75 strike price

Sell 1 'in the money' call option at $80 strike price

Sell 1 'at the money' call option at $85 strike price

Buy 1 'out of the money' call option at $90 strike price

If you were doing the long condor spread with put options, it would work in reverse. You would want the stock price to be around $77 and believe that $75 is a strong support level pending a reversal back into the price range.

The whole setup should cost you around $1 multiplied by the number of shares per contract. If the share price at expiration date is between $76 and $89 you will make some profit.

The maximum profit would be achieved if it expires between the two 'sold' positions, namely $80 and $85. You are relying on the underlying stock to retrace back to within this latter range by option expiration date.

The principal idea behind a long condor spread is to take advantage of option time decay. It is a longer term strategy so you are looking for options with an expiration period of at least 90 days out.

The major portion of realized profit occurs during the last 30 days, when time decay accelerates exponentially. The 90 day period will give you ample opportunity to assess future direction of the stock and the optimal time to close out the position.

Profit & Risk Potential

The beauty of the long condor spread is that if it carries to expiration date, it usually realizes and excellent return on risk. In the above case, for every $1 invested you should receive up to a maximum $4 in profit at option expiration. That's up to a 400 percent return. Your maximum risk is your initial debit, which in the case of our example is $1.

This being the case, if you manage your capital well, you can

have multiple positions open as you see opportunities arise. It also

means that, if taken to expiration and maximum profit achieved, you only

need one in four trades to be successful in order to break even. Anything better than that and, assuming the capital you risked on each trade is the same, you make an overall profit.

If the stock price breaks through the upper strike price in the case of calls, or lower when puts are involved, you will be at risk of having the shares assigned to you as you draw closer to expiration date. At this stage, you would need to exit at least the 'sold' positions and possibly the whole setup.

If you believe the stock will continue trending away from this breached resistance or support level, you may wish to hold your bought positions to realize more profit. An observation of longer term peaks and troughs will help you here.

Best Chart Setups for a Long Condor Spread

The best chart patterns for this strategy are channels. This is where you can draw a line over the peaks (resistance) and another parallel line under the troughs (support) and observe a sideways movement.

It could have a slight gradient up or down, but the support and resistance levels must be clear. If the stock has just retraced from the support or resistance levels, you have the ideal spot to enter the trade.

Channels, especially sideways channels, are essentially a range within which the stock is likely to continue trading. Other support and resistance areas on a chart could be noted, but you would need to feel confident that the impending reversal you expect will not result in a large move.

There are some interesting indicators that have proven quite reliable in helping us anticipate price reversals - one in particular, divergence on the RSI Indicator.

The best place to create a long condor option strategy would be when the price action of the underlying is as close as possible to the middle of the channel.

Final Points to Consider

When looking for long condor spread opportunities, you want to ensure that the credit premium you receive on the 'sold' positions will be of sufficient size to make the overall cost of the setup very cheap in comparison to the maximum potential reward. You need this in order to cover the extra brokerage you will incur upon entering and exiting the trade.

For a range trading strategy, the long condor is a very attractive one, due to its high profit potential. You don't need to limit yourself to the maximum profit potential at expiration date. You may be happy to just let some time pass and when the stock returns to an opportune place, take what would still be an excellent profit, earlier.

Top traders NEVER try to predict the market - they only manage risk

Make Money in the Market Whatever Happens, Simply by Learning the Art of Adjusting Your Positions

Watch a FREE video by Trading Pro System

New! Comments

Have your say about what you just read! Leave me a comment in the box below.