Search Options Trading Mastery:

- Home

- Index Options

- How to Use the VIX

How to Use the VIX in Options Trading

Knowing how to use the VIX should be essential for all option traders whose portfolio of positions may be affected by general market sentiment. The reason is, because the VIX, or volatility index, represents the average implied volatilty in all options traded over the underlying shares that make up the famous S&P 500 index in the USA.

Since the implied volatility in options represents future expectations of price volatility, the VIX becomes a barometer for potential broad based market volatility over the next 30 days.

This being the case, the VIX may not be so relevant to positions where the underlying assets are shares in individual companies, unless the price action of those shares is sensitive to the mood in the overall market.

Although most stock prices will react to general market direction, particularly when it is decisive, some company stocks continue to trade against the overall trend.

As previously stated, the VIX is most relevant to a broad based portfolio of positions and consequently, would be of most interest to those trading either index options, or options on index related Exchange Traded Funds (ETF's).

For example, if you trade options on the SPY, the QQQ or other ETFs that represent a broad based market, the VIX would be very relevant and should not be ignored.

What Is the VIX and Where Did it Come From?

The VIX is the ticker symbol for the Chicago Board Options Exchange (CBOE) market volatility index. Because it generally trades in the opposite direction to the S&P 500 index, it has been referred to as the "fear index".

It was developed by Prof. Menachem Brenner and Prof. Dan Galai in 1986 as an academic concept, but it was not until 1992 that the CBOE asked Prof. Robert Whaley to create a tradable stock market volatility index based on index option prices. Since then, the VIX has been computed on real-time prices.

Once established, like most indexes, by March 2004 you could trade futures and options on the VIX. These days, there are even ETFs that attempt to mimic it's performance.

How to Use the VIX in Conjunction With Your Option Trading Decisions

Let's summarise what we've established so far:

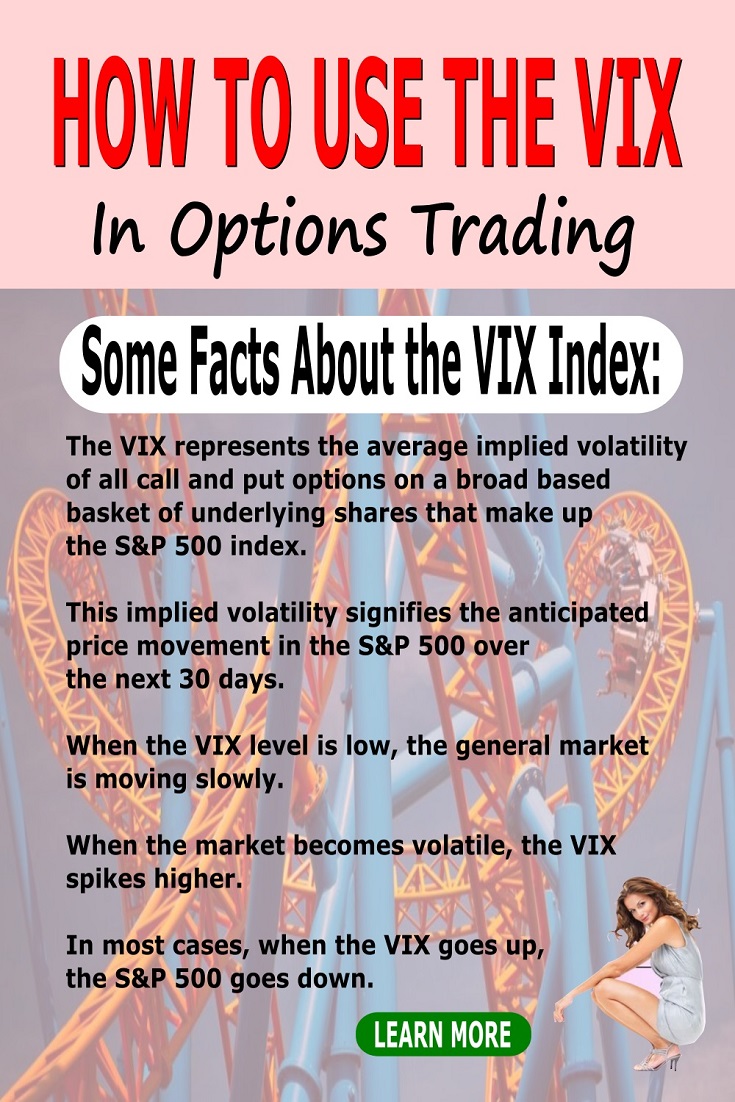

- The VIX represents the average implied volatility of all call and put options on a broad based basket of underlying shares that make up the S&P 500 index.

- This implied volatility signifies the anticipated price movement in the S&P 500 over the next 30 days.

- When the VIX level is low, the general market is moving slowly

- When the market becomes volatile, the VIX spikes higher.

- In most cases, when the VIX goes up, the S&P 500 goes down.

The theory about market volatility is, that it always returns to its mean. Periods of high volatility eventually come back to the mean, as do periods of low volatility.

So here's how to use the VIX to your advantage. While other factors have an influence, a high VIX indicates increased investor fear while a low VIX, complacency.

This is because market volatility draws fearful investors to panic buy option contracts in broad based indexes or their ETFs, in order to hedge existing positions, thus driving up the implied volatility in the premiums.

Since fear is most present when the market is falling, it is usually the put options that become expensive and in turn, affect the VIX.

This being the case, the VIX can be used in the following ways:

- As a warning signal of possible change in market direction. For example, if the market has been bullish and the VIX starts to rise, it means that investors are fearful of an impending reversal. So if you're in the habit of taking contrarian positions (anticipating a reversal), you should always consult the VIX first.

- When the VIX is high, this usually follows a market sell-off, so you should be focusing on call options. When it is low, you should be favouring put options.

- If you're using a range trading options strategy such as a calendar spread or iron condor, you want to be notified of any potential significant price movements which may threaten the breakeven boundaries of your positions.

- If you like to trade straddle options, which relish market volatility, an upturn in the direction of the VIX following consolidation at low levels may indicate impending price breakouts. Alternatively, if the VIX is indicating market complacency, it may mean that option premiums for some underlying stocks are cheap. If this is at a time when the VIX is at low support levels, it could be the best time to put on long dated straddle positions.

A relative of the VIX is the VXN. The VXN is the volatility index for the Nasdaq 100 and therefore associated with the NDX index and its associated QQQ exchange traded fund in the same way that the VIX is with the S&P 500.

How to Use the VIX With the 10 Day Moving Average

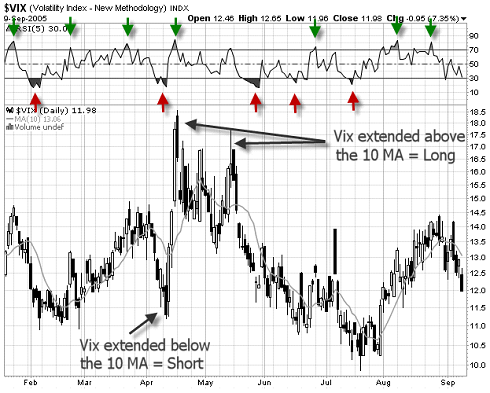

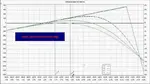

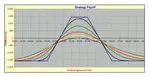

The 10 day moving average has historically proven to be an accurate predictor of price reversals in the S&P 500 index about 70 percent of the time. The rule here, is that when the VIX level reaches 10 percent above the 10 day moving average, it means that a sell-off in the S&P500 has taken its course and there is a high probability of a reversal to the upside.

Conversely, when it is 10 percent below this moving average, the potential for S&P 500 reversing to the downside is there. This can be very useful if you are trading with SPY options.

Take a look at the chart below, where we have shown a couple of examples of how to use the VIX in this way.

You'll also observe from the above chart, how the RSI can be used in conjunction with the 10 Day Moving Average, to confirm reversal points. Looking at the green and red arrows, indicating over-bought and over-sold levels at the same time as the 10 day moving average rule applies, has yielded some reliable results.

Knowing how to use the VIX effectively can be a most useful options trading technique which can provide you a significant edge over the markets.

**************** ****************

Return to Index Options Contents Page

Go to Option Trading Homepage

New! Comments

Have your say about what you just read! Leave me a comment in the box below.