Search Options Trading Mastery:

- Home

- Option Spread Trading

- How to Do Credit Spreads

How to do Credit Spreads

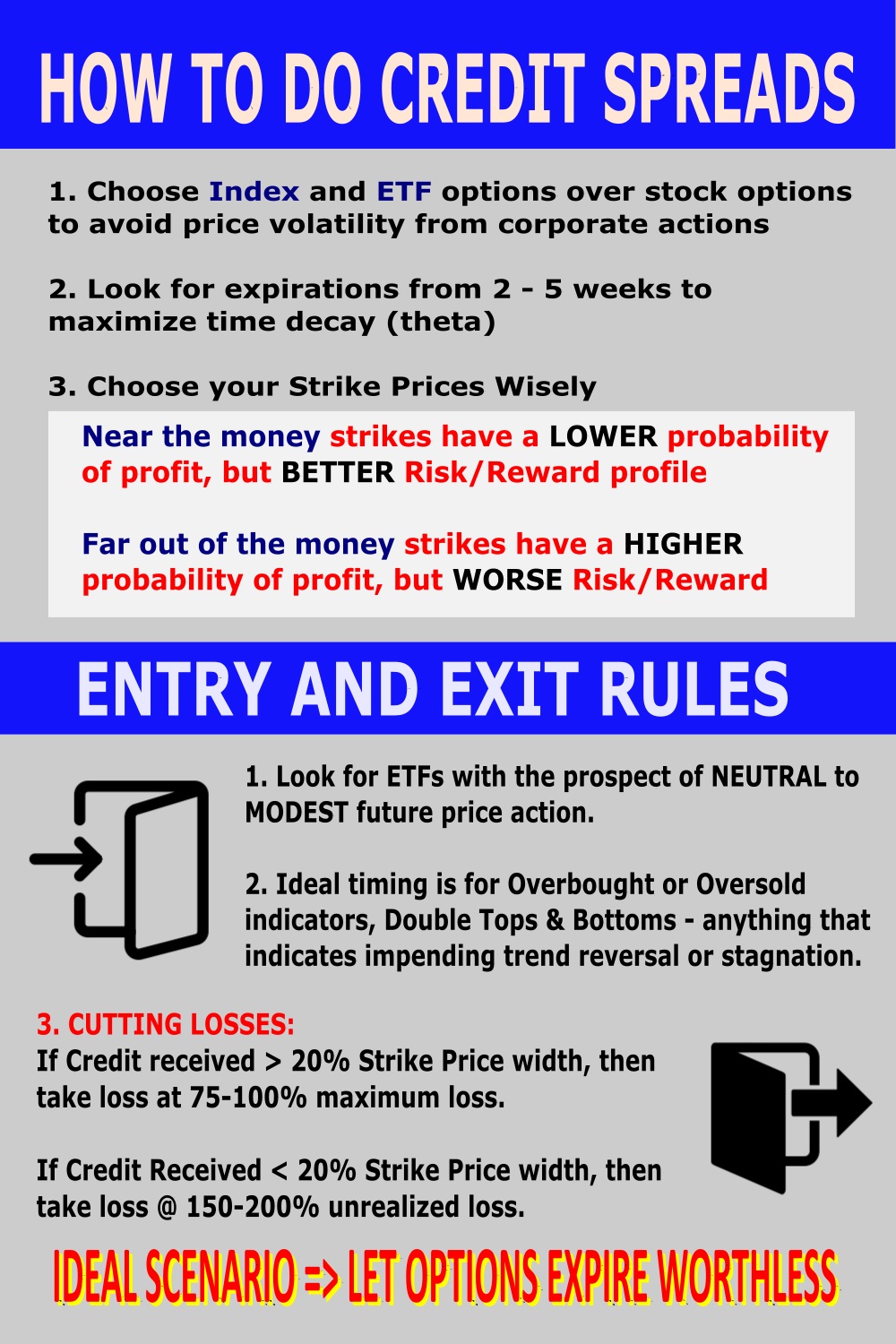

How to Do Credit Spreads - Risk and Probability of Success

This story about how to do credit spreads is really interesting. There are huge benefits with this nice option trading strategy.

The Short Version:

SELL option contracts to the market, at a strike price that is closer to the current market place of the underlying than the option contracts that you BUY.

Both options positions cover the same number of underlying assets and both have the same expiration date.

By doing the above, you have created a "vertical credit spread".

The premium received from the sold option should be greater than the further "out of the money" bought options, resulting in a credit to your brokerage account at the time of the trade.

Over time, the 'sold' option premium will experience time decay, otherwise known as "theta" - and as long as the share price does not pass the sold position strike price at expiration, you keep the full credit.

There are two ways how to do credit spreads - either a low risk trade or a high probability trade. Let's examine both.

How to do Credit Spreads - Higher Risk But Greater Reward Way

The low risk method comprises a combination of "sold" in the money (ITM) or at the money (ATM) options and the same number of "bought" positions that are out of the money, i.e. further away from the current market price of the underlying.

You also need to pay attention to the distance between strike prices that you choose. Take a look at the image at the end of this article, for a guide.

Let's use the example of a stock, index or ETF currently trading at $55.00.

Your technical analysis leads you to have a bearish outlook for the stock and you believe that between now and expiration date, it could fall to under $50.

So you create a credit spread with call options, known as a Bear Call Spread.

You sell a $50 ITM call for $ 5.75 and buy an ATM $55 call for $2.00 for an overall credit of $3.75.

The maximum loss for the spread, is the difference between strikes, i.e. $5.00 per share (55-50), less the credit which you receive. So your maximum risk is $1.25 per share (5.00 - 3.75).

This why it is a low risk strategy. You receive $3.75 for a maximum loss of only $1.25, which is a 300% return on risk. When you understand how to do credit spreads, you prefer a high yield for low risk.

So what could go wrong with this trade? The probability of success. The stock must fall to under $50 between now and expiration date for it to be a successful trade. You need to be correct in your assessment of the direction of trade. So knowing how to do credit spreads this way involves prediction of future market direction.

How to do Credit Spreads - High Probability But Lower Return Method

A high probability strategy involves a credit spread setup using all out of the money (OTM) options.

Taking the above example of a stock currently trading at $55.00, together with an expectation that its upward move has exhausted itself which means that you have a short term bearish outlook, likewise anticipating a fall below $50.

We create a credit spread using different strike prices using call options which are all above the current trading price.

You might sell an OTM $65 Call for $1.10 and buy an OTM $70 Call for $0.50 resulting in an overall credit of $0.60.

The maximum loss is still $5 which means your risk in this scenario will be $4.40 - much higher than in the previous example. This creates a higher risk trade - only $0.60 maximum return for $4.40 risk, which is only a 13% return on risk.

The difference however, is the probability of success for the trade. The stock must close below $60 at expiration and since it is now only $55 and you feel the stock is weak and will go lower, the likelihood of keeping all your options credit is high.

We have seen the difference between a low risk setup with a low probability of success for someone unfamiliar with stock analysis - or a higher risk trade but with a high probability of success. These are the two extreme alternatives for the credit spread trader. It all comes back to your choices of strikes - and there will usually be variations in between.

What you choose to do depends entirely on your trader personality. You may prefer to receive more for a trade but also be prepared to make adjustments in the event of price action going the 'wrong way'. These adjustment take the form of rolling out your trade to a later expiration month, or "rolling up or down" (depending on whether it's calls or puts) by exiting your current position and opening a new one.

The above two examples assume a $5 difference between option strike prices for the underlying stock. You can of course, find many optionable stocks with $2.50 or less between available strike prices. This will provide greater flexibility for how you set up your credit spread. But remember, the one important thing you need to know before you press the submit button, is your risk to reward ratio.

Did You Know That You Can Make a Good Living Using Option Credit Spreads?

Want to Know the "Nuts and Bolts" of How to Do It?

To Find Out How Easy it Is, Click Here

****************** ******************

Return to Option Spread Trading contents page

Go to Option Trading Homepage

New! Comments

Have your say about what you just read! Leave me a comment in the box below.