Search Options Trading Mastery:

- Home

- Advanced Strategies

- Calendar Straddle

The Calendar Straddle Options Strategy

Enjoy the Flexibility of the Calendar Straddle - One Covers the Other

The Calendar Straddle is an option strategy formulated to earn profit when low volatility is present in the underlying asset. It is also called a a neutral option strategy.

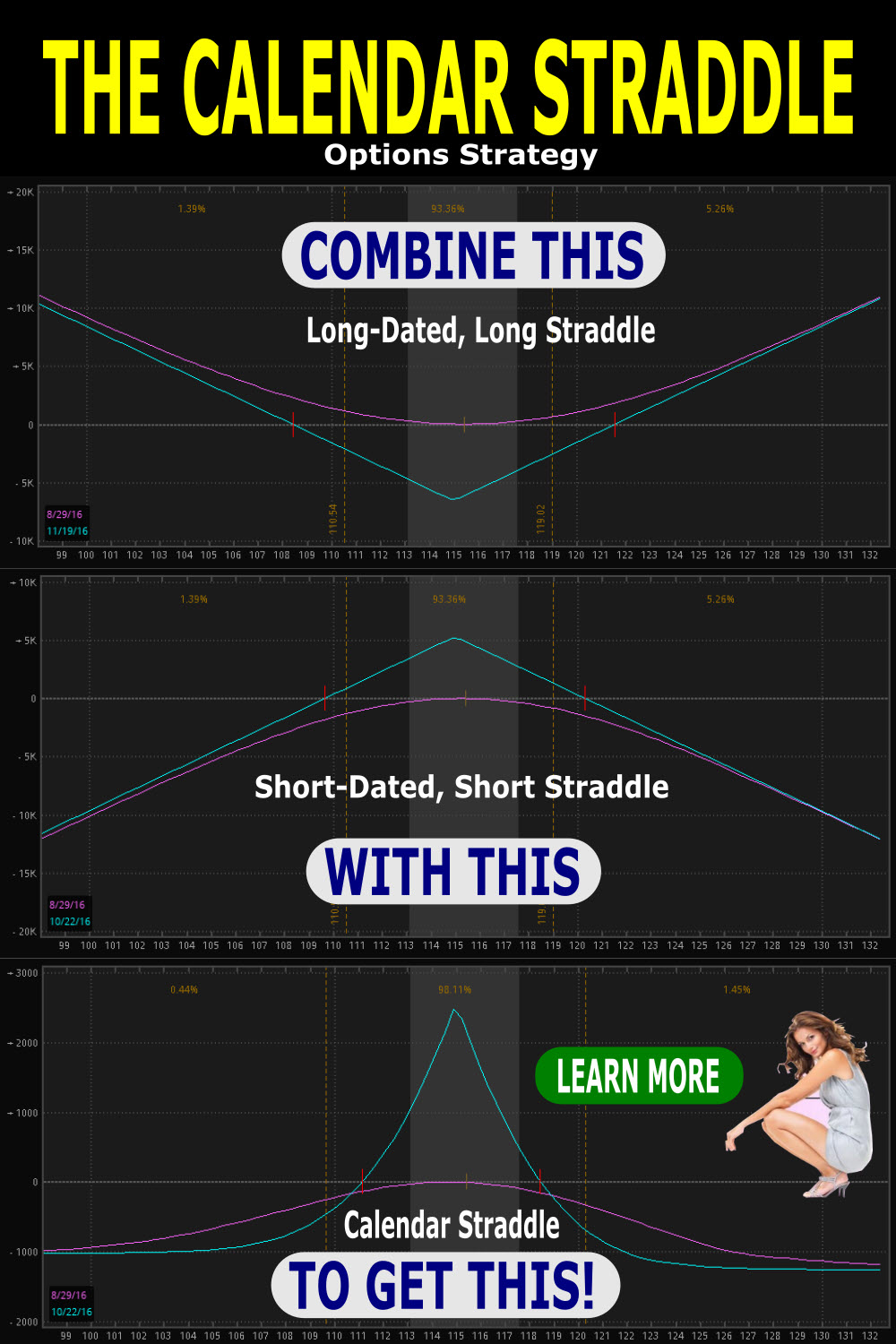

It is a combination of both a short term straddle and a long term straddle. The trader sells the short term straddle and buys a long term straddle with the objective of realizing profit due to the slower rate of time decay on the long term straddle compared to the short dated one.

Since short dated options expire more rapidly than longer dated ones, the difference becomes your profit.

A calendar straddle is classified as a horizontal spread because the trader purchases option contracts that expire on one date while selling other options expiring on another date. You're also looking to take advantage of the differences in the options implied volatility for different time periods.

As a trader you should only use this strategy when you can purchase the longer dated options at a relatively cheaper price than the shorter dated ones that you're selling.

The best time to use a calendar straddle strategy is when the price action of the underlying stock or other asset is expected to remain stable in the short term but in the longer term should break out to make a more significant move. In this case, all the options should finish at the same strike price.

How the Calendar Straddle Profits

This type of trading is mostly done by experienced option traders. Profits can be achieved in two different ways.

Firstly, from the higher rate of time decay on the short dated options compared to the long dated ones, and secondly, through a secondary profit realized by the longer dated straddle following a reasonable price movement in the underlying later on.

The strategy is appealing because it has the ability to profit when the price action of the underlying asset is stagnant. It also offers flexibility to the trader to cash in on the long term straddle when the value of the stock is expected to reach a breakout stage. It also has limited risk with no margin required to hold the trade.

If you expect the value of the underlying to move significantly shortly after expiration of the short dated options (weekly or monthly) then you can allow the short dated straddle to expire without rolling further.

If not, then once expired, and assuming your long dated options are a few months away, you may wish to sell another short dated straddle position and receive more income if you think the conditions are right.

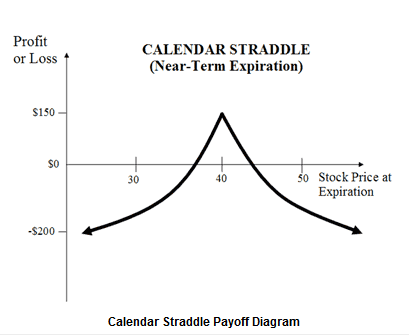

The profit associated with this trading technique is limited in the short term but can be huge in the longer term. Losses are limited to the net debit after subtraction the credit from the short position from the longer dated straddle. Using risk graphs, you can determine your expected profit levels.

Calendar Straddle strategies provide one of the best opportunities to benefit from stocks with consolidating or stagnant price action or in a tight trading range.

From a technical analysis viewpoint, you might look for a stock or ETF that has made its first lower-high and higher-low. This means that it is potentially heading into a triangle chart pattern.

Triangle patterns consolidate price action, followed by a price breakout to either side and is often accompanied by volatile price action.

The consolidation period is idea for profiting from the short straddle, while the later price volatility allows the long dated, long straddle to also profit.

The only disadvantage is that profit potential is limited up until the expiration of the sold options.

After that, if you're lucky, the price of the underlying could explode, the implied volatility might balloon on your bought positions so that theoretically, profits could be unlimited.

The calendar straddle, or neutral option strategy, is an advanced option trading strategy. It is simple to implement and the only variations might be how far away you choose for expiration of your long straddle.

The determining factor would be implied volatility (IV). You should choose months with the lowest IV. Doing it right, you can make a stable income with minimal risk.

**************** ****************

Return to Option Trading Strategies Contents Page

Go to Option Trading Homepage

Add a Comment

We and other readers of this information site value your input.

You can also (optionally) include any graphics such as charts, if you wish.

New! Comments

Have your say about what you just read! Leave me a comment in the box below.