Search Options Trading Mastery:

- Home

- Commodity Options Trading

- Soybeans Options

Soybeans Options Explained

Soybeans options are a commodity based options contract wherein the underlying financial asset is a soybean futures contract. These futures contracts are agreements between buyers and sellers, to take delivery of an agreed quantity of soybeans on a predetermined delivery date.

The value of the options contracts are based on, among other things, price movements in the futures contract, which in turn, are affected by the current market price of soybeans.

If you own a call option on soybeans, you will profit if the price of soybeans futures rises. This is because a call option gives you the right but not the obligation, to take a long position in the underlying futures.

If you have purchased put options on soybeans, you're anticipating a fall in soybeans futures because put options give you the right but not the obligation to take a short position in the futures. Once the options expiration date has passed, your rights to profit from either of these underlying price movements will cease.

Where Soybeans Options are Traded

The place to go for these options prices is either the Chicago Board of Trade (CBOT) or the Tokyo Commodity Exchange (TCE). The CBOT Soybeans Options are "American style options" which are quoted in US dollars and traded in connection with an underlying futures contract covering 5,000 bushels (136 metric tons) of soybean.

The underlying TCE futures contracts are traded in 50 tonne units and prices are quoted in Japanese Yen, per metric tonne. Options prices will reflect this.

If you're bullish on the price of soybeans, you could either buy call options, a bull call debit spread, or sell a bear call credit spread. If you're bearish on soybean prices, you could buy put options, or a bear put debit spread, or sell bull call credit spreads.

If you don't know which way the price of soybeans will go but believe that its price action will soon become volatile, you could use straddle or strangle option strategies.

Why Soybeans Options and Not Futures?

The advantage of trading options instead of their underlying futures, is that you have more opportunities for a variety of trade setups using any number of option trading strategies, some of which are mentioned above. Futures contracts don't provide this flexibility.

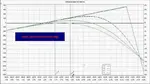

Not only so, but with options, your potential losses are always limited to either the amount invested, or the margin used, depending on the type of strategy you're employing. In contrast, losses on adverse movements in futures contracts are potentially unlimited.

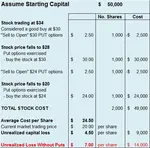

Moreover, since your options positions are based on the underlying futures contract, you gain additional leverage on price movements. Options on futures are much cheaper than the futures contracts themselves. However, you could also combine soybeans options with futures contracts.

For example, you could hedge long futures positions with put options, or short futures positions with call options. Because the pricing models of these derivatives work differently, you can often use this to realize and overall profit. You could also construct a covered call type setup using both long futures and call options.

There are many interesting alternatives.

With options you should always be aware of option time decay (sometimes called theta decay). If you're an option seller, this works to your advantage, but if a buyer, your out of the money positions will erode rapidly as expiration date approaches.

To start trading soybeans options, simply open an account with any reputable broker such as ThinkorSwim by TD Ameritrade and you'll have the choice of trading futures, options, or both.

**************** ****************

Return to Commodity Options Trading Contents Page

Go to Option Trading Homepage

Add a Comment

We and other readers of this information site value your input.

You can also (optionally) include any graphics such as charts, if you wish.

New! Comments

Have your say about what you just read! Leave me a comment in the box below.