Search Options Trading Mastery:

- Home

- Advanced Strategies

- Option Strangle

The Option Strangle Strategy Guide

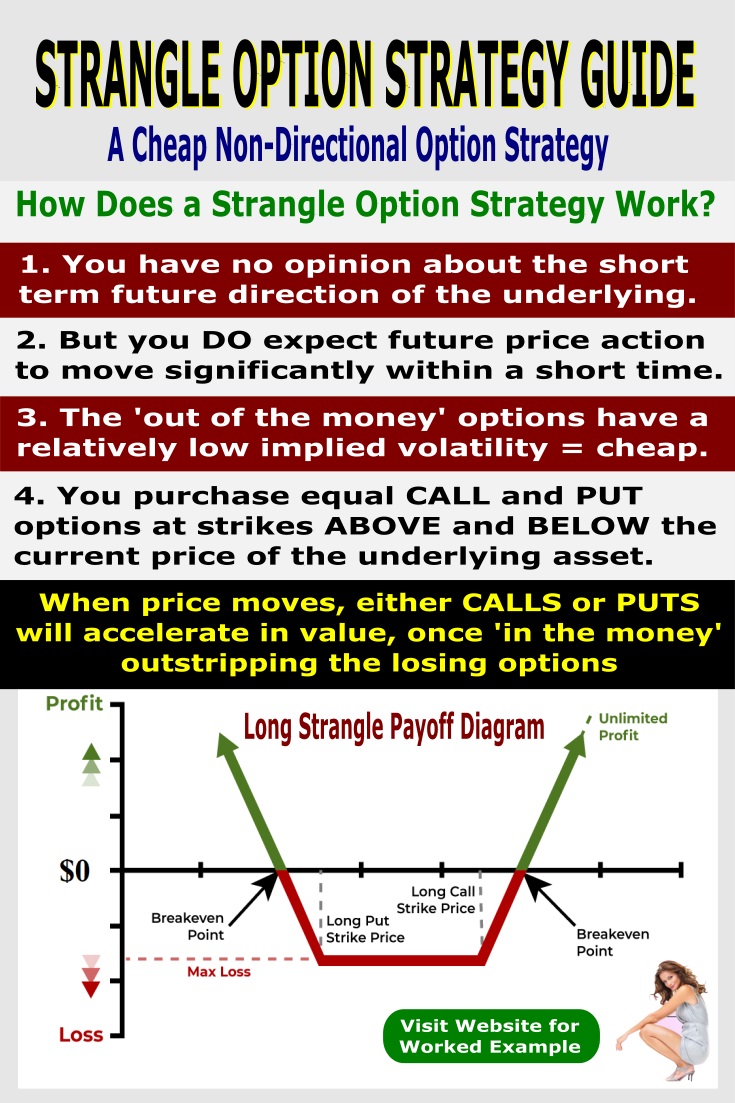

The Option Strangle is an option trading strategy which relies on three important prerequisites:

(1) That the investor has no particular opinion as to the short term future direction of the underlying stock or other security, and

(2) That the future short term direction of the underlying stock is expected to be volatile - i.e. it is anticipated that it will move strongly in one direction before the options expire.

(3) That the options you are considering purchasing are relatively cheap.

The first two of the above three criteria are absolutely essential for an option strangle trade to be successful. The third criteria is almost as important.

The option strangle is a cheaper alternative to the straddle. It involves purchasing an equal number of call and put options, usually with an expiration date of at least 3 months out.

You want to give yourself plenty of time to be right and you also want the effects of option time decay to be minimized as much as possible.

It also needs to be carefully analyzed before execution because if your positions are too expensive due to inflated implied volatility in the option prices, you don't stand much of a chance of making money unless the price movement in the underlying is positively huge.

The ingredient that distinguishes the option strangle from the straddle is that, unlike the straddle where call and put options are purchased "at-the-money" a strangle position is defined by all purchased options being "out-of-the-money" (OTM).

This is why a strangle is usually somewhat cheaper than the straddle . . . out-of-the-money options have no intrinsic value, only time value.

Purchasing longer dated OTM options will have more time value than near month options and therefore be more expensive, but the reduced risk from slower time decay is worth it.

Let's illustrate an option strangle with a practical example

Our imaginary stock is trading at $35 and we believe that within the current or next month all the signs point to a large move at least $5 in either direction.

For indicators of possible upcoming large moves, see our article on the option straddle.

So here's what we do:

Buy 10 call option contracts with an exercise price of $37.50.

Buy 10 put option contracts with an exercise price of $32.50.

Both these strike (exercise) prices are $2.50 out of the money.

Within the month, the stock price falls to $30. The put options are now $2.50 in-the-money, plus their remaining time value, so they have become quite valuable - so much so in fact, that their current value is worth more than the combined cost of the original OTM call and put options and then some.

So you close out both the positions for a nice profit.

If some really bad news came out and the share price plummeted to $20, you would make even more profit from the put options. Theoretically, on the call option side, your potential profits are unlimited.

On the put option side, the most a stock price can fall to is zero so that does place some limit on potential profits. But if the fall is from $35 that's a still lot of profit.

The final, but no less important, matter to mention when deciding on an option strangle strategy, is the implied volatility in the price of the OTM options. You need to compare IV with the historical volatility (HV) of the stock and ensure that the IV (expressed as a percentage) in the option price is less or equal to the HV of the stock.

In other words, make sure the options are not overpriced.

Often in periods of low stock volatility before a price breakout, the option prices will also become quite cheap.

This is an ideal opportunity for a strangle trade. Once the underlying stock price becomes more volatile the options price will also reflect that volatility and increase in price more dramatically than if you had bought them during a more volatile period.

**************** ****************

Return to Option Trading Strategies Contents Page

Go to Option Trading Homepage

Add a Comment

We and other readers of this information site value your input.

You can also (optionally) include any graphics such as charts, if you wish.

New! Comments

Have your say about what you just read! Leave me a comment in the box below.