Search Options Trading Mastery:

- Home

- Option Spread Trading

- Trading Credit Spreads

Trading Credit Spreads

Trading Credit Spreads "In the Money" - Some Advantages

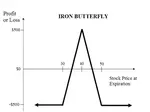

Trading credit spreads has traditionally been considered a flexible, low risk - but also low return on risk (ROR), option trading strategy. The usual scenario that is presented is one that involves opening both the short and long legs of the spread "out-of-the-money", in the hope that the price action of the underlying moves away from both strike prices and thus, you get to keep all the credit.

Typically, an option credit spread involves about 20 percent return on risk over a maximum 4-6 weeks to expiration, with the idea of taking advantage of option time decay (otherwise known as 'theta' if you like 'the greeks').

But have you considered the advantages of trading credit spreads with the short position in-the-money and the long (bought) leg of the spread at-the-money? Structuring a credit spread this way is an alternative to your typical debit spread - only with the added advantage of option theta (time decay) working even more in your favour.

To illustrate, let's take an example using a well known exchange traded fund (ETF) that is linked to the Nasdaq 100 - the QQQ. The popularity of QQQ option trading has risen dramatically since its introduction in 1999 so it gives us a realistic set of numbers to work with.

At the time of writing, the QQQ closed at $56.65. Let's say we have a bearish outlook for the index fund over the next few months and believe it could at least fall back to the long term support level of $50.00.

At this point, to profit on our outlook we could do one of the following three scenarios:-

1. Buy at-the-money $56 put options

2. Enter a debit spread by going long $56 puts and short $50 puts

3. Decide we are trading credit spreads, so we sell some deep-in-the-money

$50 CALL options and buy some $56 at-the-money call options.

For simplicity, we'll assume we have only purchased one option contract with 90 days to expiration and disregarding broker commissions.

In scenario 1, our maximum risk is $188 but our potential reward is unlimited. However, we'll assume that by expiration date the underlying QQQ fund has fallen to $50.00. At this point, our long put option would return us a profit of $409.85.

Scenario 2 would cost us $128.00 and this would be our maximum risk. Our potential profit at expiration would be $472.00 and even if the price dropped below $50.00 this would be all we could make.

Scenario 3 where we are trading credit spreads, gives us virtually the same result as our debit spread. Our maximum risk would be $126 and potential reward would be limited to 474.00.

This is a 376 percent return on risk. If we had chosen 60 day options the maximum ROR would be more like 466 percent. 30 day options have a 710 percent maximum return on risk. It's a trade-off for extra time and how quickly you think the price of the underlying will reach your target.

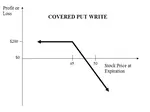

The risk graphs for scenarios 2 and 3 look very similar - and both provide less risk and greater profit potential, up to the point where the QQQ has fallen to the $50 level.

One advantage from taking the credit spread alternative, is that we receive a credit to our account which accrues interest for us. Also, since it is more predominantly a short position, we have option time decay (theta) working more favourably for us, increasing our chances of profit.

This method of trading credit spreads as an alternative to the traditional debit spread, can be used on any underlying financial instrument. It is advisable to observe the implied volatility levels for both legs of your intended spread before making your final choice.

**************** ****************

Return to Option Spread Trading Contents Page

Go to Option Trading Homepage

New! Comments

Have your say about what you just read! Leave me a comment in the box below.