Search Options Trading Mastery:

- Home

- Option Spread Trading

- Diagonal Spread

The Diagonal Spread in Options Trading

The Diagonal Spread - The Best of Both Worlds

The diagonal spread is one variation of option spread trading that has been used most effectively to adjust existing spread positions.

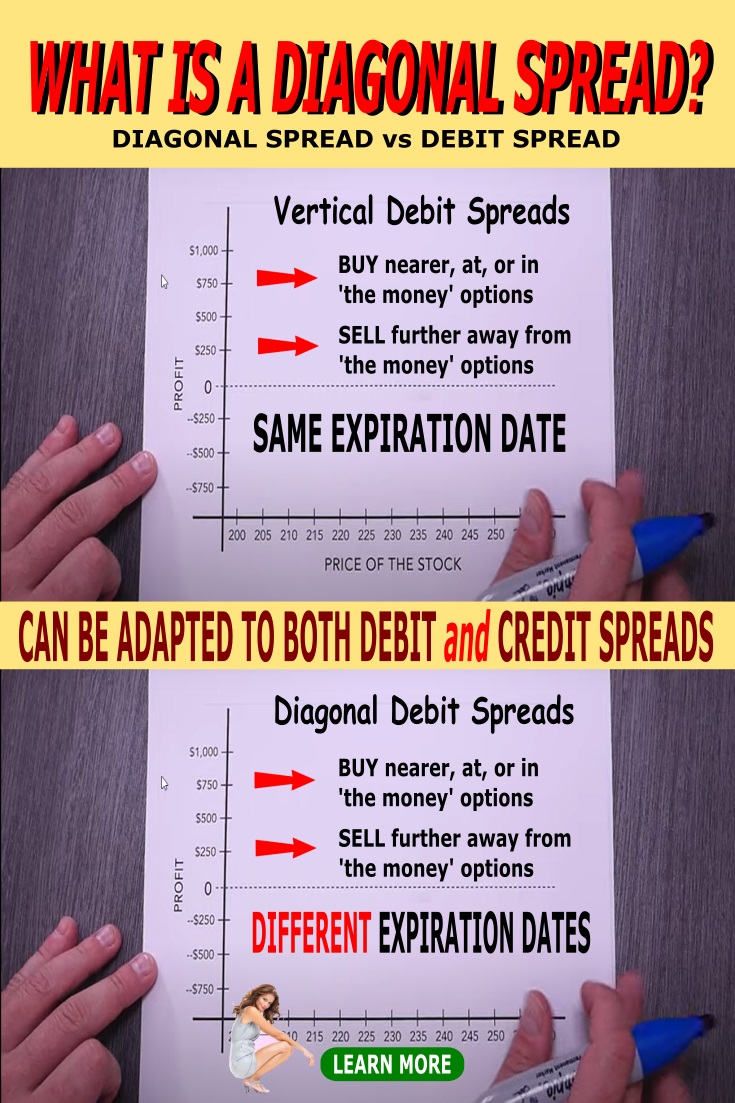

It is called by this name because unlike regular vertical spreads where you go long one strike price and short another - the diagonal spread includes the extra dimension of different expiration dates.

If you think of expiration dates as the horizontal aspect of option spreads and the strike prices as the vertical aspect, then combining the two is what creates the "diagonal" effect - and hence the name.

This strategy uses the same type of option contract - i.e. all calls or all puts. The most appropriate application is going short (selling) the front month and long (buying) the later expiration month in order to take advantage of option time decay, or "theta".

Since the value in the front month options will erode at a greater rate than the later month options, this is where the advantage lies.

Diagonal spreads can be adapted to both credit spreads and debit spreads.

If you are creating a diagonal credit spread, then since you are selling the front month expiration and buying the later month, the greater time value in the later month premium will mean you will receive less credit than you would from a regular vertical credit spread.

In such cases, you should take into consideration the implied volatility in the later month options as well as the distance between the strike prices, as part of your strategy.

If your diagonal spread is entered with both strike prices 'out-of-the-money' the ideal scenario is that price action of the underlying will trade closer to, but won't breach, the strike price of the sold options by the time they expire.

If this happens, you will keep all the premium from the sold options but still retain a long position which is now closer to the money and comes with another month or more time value still remaining.

Depending on the difference between option expiration months and the length of time it has taken for the underlying to trade to this level, it is quite likely that the long position is also now more valuable and can be sold for maximum profit.

The above works particularly well with put options because increased implied volatility usually inflates put option prices when fear overtakes the market. So the back month long position has better value.

But if the price action of the underlying falls away from the closer short strike price, you simply get to keep the overall credit received when you entered the position.

Diagonal Spread Example

A company or ETF's shares are currently trading at $45 and you wish to construction a call diagonal spread position.

- Sell 10 XYZ $50 January call options for $5

- Buy 10 XYZ $55 March call options for $2

You receive an overall credit to your account of $3

You'll notice the vertical aspect is a $5 difference in strike prices and the horizontal aspect is a 2 month difference in expiration dates.

If the price of the underlying trades up to $50 at the front month expiration date, you get to keep the $3 credit you received.

At this time the later month $55 long call option will now be worth more, being closer to the money but with remaining time value (let's say $2.50) so you can choose to sell this for an overall profit of $5.50 times the number of shares covered by the option contracts.

You have risked $2 being the difference in strike prices ($5) minus your initial credit ($3), to make $5.50. This scenario gives a good return on risk.

The diagonal spread can be adapted to both credit and debit spreads, each with their own risk to reward ratio. You can adapt them to the following vertical spreads:

The Diagonal . . .

More comprehensive information about diagonal spreads, calendar spreads and double calendar spreads, including how to "trade by the numbers" using the option "greeks" can be obtained from a series of downloadable videos obtainable from the Options Trading Pro System.

**************** ****************

Return to Option Spread Trading Contents Page

Go to Option Trading Homepage

Add a Comment

We and other readers of this information site value your input.

You can also (optionally) include any graphics such as charts, if you wish.

New! Comments

Have your say about what you just read! Leave me a comment in the box below.