Search Options Trading Mastery:

- Home

- Option Spread Trading

- Iron Condor Setup

What is the Best Iron Condor Setup?

The Secret to an Effective Iron Condor Setup

The best iron condor setup can make all the difference between realizing consistently profitable vs sometimes winning, sometimes losing, results when using this popular option trading strategy.

So why is the iron condor so popular? The main reason would be, that it's a strategy which doesn't require you to predict the future direction of the underlying. As long as the underlying asset remains within your predetermined price range within your chosen time period, you automatically realize a profit.

The second reason is, that unlike regular credit spreads,

iron condors bring in twice the credit without your broker requiring

any extra margin for the trade. The reason for the break they give you

on margins is, that whatever happens after the trade is placed, only one

side can ever lose.

But it's not all an easy run to the bank.

There are some important things that you need to remember before risking

your capital on just any iron condor, because when they go wrong, your

potential losses can be much greater than your anticipated profits. So

you need to choose your iron condor setup wisely.

Here are a few things to consider before trading iron condors:

- Profits are limited to the double-credit you receive.

- Adjustments to the positions may be necessary, should the break even points be threatened.

- The timing of your entry into the position is important.

- The underlying financial instrument you choose is important.

- The wider your break even points, the less credit you will receive compared to the capital you risk, but the likelihood of these point being breached is also reduced.

With the above in mind and depending on your own personal risk profile, we propose the following two Iron Condor setup suggestions:

Iron condor setup No. 1

This position should be placed on monthly options only and between 40 and 30 days before option expiration date. You should aim to bring in a credit of at least 70 cents per contract.

As the time draws closer to expiration date, the position should be monitored for potential breaching of the chosen range. Should this occur, adjustments should be made so that profit potential is maintained.

Adjustments of this nature often narrow the break even points somewhat, which puts the position in greater risk of being breached as option expiration date approached.

The position should be exited before expiration week arrives. The reasons why are explained in detail in the Trading Pro System training modules.

Iron Condor Setup No. 2

Our second proposal has a very low probability of becoming unprofitable - but the tradeoff is, that you don't receive as generous a profit either. So if your trading approach is, that you're happy with 10 - 15 percent return on risk per month, with a view to growing your capital slowly by compounding it, this strategy is for you.

Here's how it works.

You place an iron condor trade in the usual way, except that your "sold" positions must have a delta of around 0.10 give or take a point or two. This effectively means that your short positions will only have about 10 percent chance of being breached and therefore, 90 percent chance of success.

An Iron Condor setup done this way will have a very wide range for profitability. This is its major advantage. If you compare this range with a chart of the underlying, you'll see that the likelihood of it failing is quite remote.

Even if the break even points are in danger of being breached, you can always adjust, providing there is enough time left before expiration to maintain a reasonable profitability level.

You will quite often be able to let these positions expire worthless and realize the full profit potential of the credit you've received.

If you combine this iron condor setup with the right choice of underlying asset, your likelihood of success is even greater. The best stocks to use this strategy on, are Exchange Traded Funds (ETFs) rather than individual company stocks.

The reason is, that their portfolio of shares and derivatives are designed to mimic the performance of an index. Since indexes don't have huge price action gaps, they are a much safer option for this strategy.

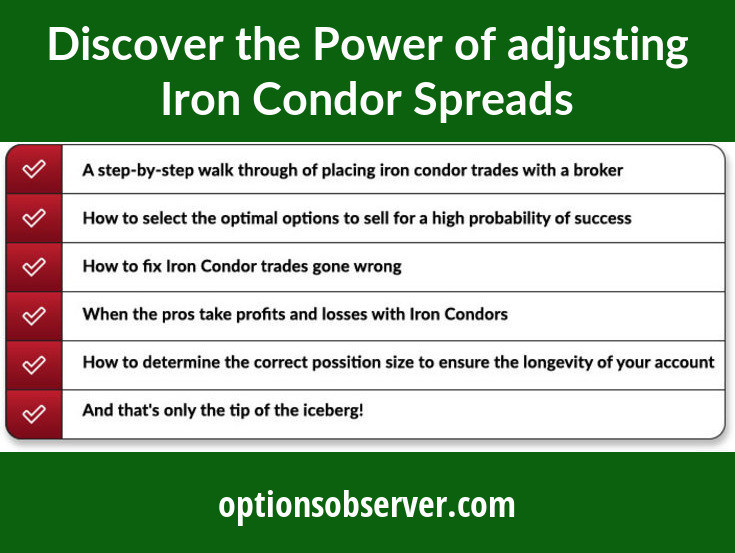

For further information about using Iron Condors for monthly income, the people who designed the popular Trading Pro System have produced a series of videos that explain it all in detail, together with a number of other advanced strategies for long term wealth creation.

OR

**************** ****************

Return to Option Spread Trading Contents Page

Go to Option Trading Homepage

New! Comments

Have your say about what you just read! Leave me a comment in the box below.