Search Options Trading Mastery:

- Home

- Index Options

- Index Options vs ETF Options

Index Options Vs ETF Options

The Real Differences Between Index Options vs ETF Options

When you're trying to decide about index options Vs ETF options, you might initially have a hard time figuring out which one is best. They both have their advantages and disadvantages.

So let's explore these differences. You should look at what you are receiving as well as how everything is going to work for you.

The advantage that Exchange Traded Funds and indexes have in common is, that because they are both averages of a large basket of company stocks, they are not subject to the same level of unpredictable price fluctuations that come about following news events.

An individual company's share price might jump overnight by 35 percent following a takeover bid, but the stock index which it forms part of won't be affected in the same way, as the balance of all the other companies included in the index will dilute the effect. This makes for more predictable trading.

So let's explore index options vs ETF options by taking each one individually.

ETFs (Exchange Traded Funds) are by far the more highly traded of the two. One reason for this is the fact that ETF options will change in value throughout the trading day while index options are settled only after the closing bell.

Trading ETFs makes it easier for day traders to take profits. For other traders, it also means that your positions will be filled more easily. For example, the QQQ (ETF) is the most highly traded financial instrument on the planet.

Index related ETFs function like normal listed companies. If you hold shares in an ETF at ex-dividend date, you receive dividends. If your option contracts are exercised, you are delivered the underlying shares.

When we say "index related" it means that the basket of shares and/or derivatives held by the trust fund is designed to mimic the price movements of a related stock market index.

Index options on the other hand, are mostly European style options (with the exception of the OEX) which means that they can only be cash settled at expiration date.

ETF options are American style options which can be bought and sold anytime at their exchange traded price.

Here are some examples for the US markets:

- The ETF for the S&P500 index is called the SPY.

- The ETF for the Dow Jones Industrial Average is the DIA.

- The ETF for the Nasdaq100 index is the QQQ.

- The ETF for the Emerging Markets index is the EEM

There are also ETFs for industry sectors, currencies, treasury bonds and commodities, but here we are concerned about comparing stock index options vs ETF options. Since ETFs come in many different types, you will be able to find a market or industry that suits you.

Because ETFs are much lower priced than their related indexes, they provide much greater flexibility for trading opportunities.

For example, when the S&P500 index is trading at 1200 points, the related share price of the SPY (ETF) will be around $120.

Call or put options on shares trading at $120 will be much cheaper than on their 1200 point counterpart. One option contract on the SPY exposes you to $12,000 in market value, while the same on the S&P500 (SPX) requires $120,000 in market exposure.

Some of the best options trading systems have index related ETFs as their preferred financial instrument.

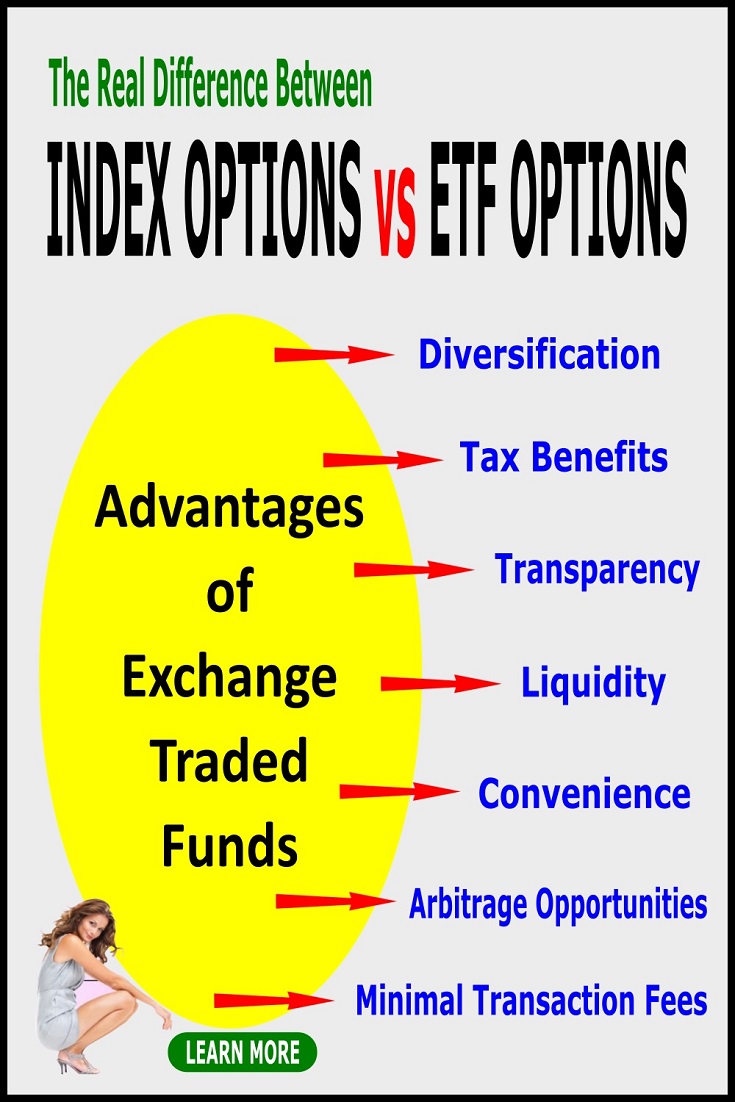

Before you jump on either side of the index options vs ETF options debate, you should think about what you need. Overall, they are very similar in terms of price action, but ETFs provide far greater liquidity, flexibility and opportunity, both for day trading and more advanced options strategies such as iron condors and calendar spreads.

When you are thinking about index options Vs ETF options, you should take into account how they differ and what would be best for your individual needs so that you can make the most from your investment.

**************** ****************

Return to Index Options Contents Page

Go to Option Trading Homepage

New! Comments

Have your say about what you just read! Leave me a comment in the box below.