Search Options Trading Mastery:

- Home

- Explain Option Trading

- How to Start Options Trading

How to Start Options Trading for Beginners

Whether you're looking for a new investment channel or seeking to diversify your portfolio, you've likely heard about options trading. However, the question "How to Start Options Trading?" might feel overwhelming. This article elucidates the course you need to chart in your journey to becoming a successful options trader.

Options trading presents a unique opportunity where you can speculate on the future price movements or hedge your investments against potential loss. What sets it apart from other forms of trading is that you are not buying or selling a commodity or asset. Instead, you’re buying or selling a contract that gives you the option to buy or sell a particular asset at a later date.

Options trading comes in two forms: call options and put options. A call option gives you the right, but not the obligation, to buy an asset at a specific price within a specific period. Conversely, a put option gives you the right to sell under the same conditions. These mechanisms form the basis of options trading.

How to Start Options Trading for a Living

Trading options for a living may seem daunting to beginners because of its complexity and the knowledge needed. But don't worry! You can start learning by understanding four key components:

- the underlying asset,

- contract multiplier,

- expiration date, and

- strike price.

The underlying asset in options trading can be stocks, indices, commodities, or even other financial derivatives. The contract multiplier defines the number of assets that one contract controls. The expiration date is the defined time when the option expires, and the strike price is the price at which the option can be exercised.

As you prepare to start trading, understanding the inherent risks is crucial. The biggest risk in options trading is the possibility of losing your entire investment. However, the risk is limited to the amount you invest in buying the contracts.

On the positive side, options trading offers substantial benefits. The most significant is the ability to leverage your investment. With options, you control a larger amount of the asset with a small investment, maximizing potential profits. Plus, options allow you to hedge against potential losses in your portfolio.

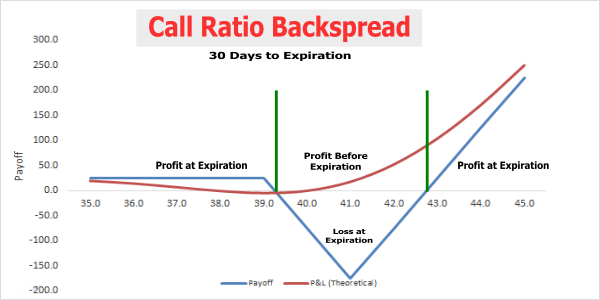

Different strategies, each with its own risk profile and potential return, can be deployed in options trading. Strategies used by professional traders include long calls, long puts, protective puts, covered calls, and various spread strategies. Knowing when to use these strategies is critical to your success.

The call calendar spread, among the spread strategies, is known for its effectiveness in a market where the underlying financial instrument is expected to rise in the short term, but not by too much. The strategy involves selling a near-term out-of-the-money (OTM) call, reducing the cost of buying a long-term OTM call.

The psychology of options trading plays a significant role in your success. It teaches you patience and how to handle fear and greed, which are the bane of many traders. Embracing discipline, taking calculated risks, and managing your emotions are key psychological traits to master.

Now that we've covered the basics and importance of understanding the strategies, benefits, risks, and psychological aspects of options trading, let's dig into the steps of how to start options trading.

How to Start Options Trading Step by Step

The first step is education. Dedicate time to learn about options trading, its terminologies, strategies, risks, and rewards. Many free resources are available online, including webinars, eBooks, video tutorials, and forums where beginners can learn from experienced traders.

The second step is to set clear objectives. Why do you want to trade options? Is it for speculative purposes, to generate income, or to hedge your portfolio? Understanding your goal will help determine your approach to trading.

The third step is to choose a reliable options broker. Look for a broker that offers a user-friendly platform, comprehensive educational materials, responsive customer support, competitive fees, and who is regulated by financial authorities.

Once you've chosen your broker, the fourth step is to open a brokerage account. Opening an account typically involves providing basic personal information, passing a suitability test, and making a deposit. Once your account is open, you'll be able to purchase and sell options.

Step five involves setting up a trading plan. Your plan should detail everything from the capital you're willing to risk, your chosen strategy, entry and exit points, and how you'll manage your trades.

The sixth step is to start paper trading. Paper trading involves practicing your trading skills without using real money. It’s an excellent way to test your understanding of options trading before you jump in.

Finally, once you're comfortable with your trading plan and have experienced some success with paper trading, it's time to start trading with real money. Start slowly, perhaps with a few contracts, and gradually increase your exposure as you gain more experience and confidence.

Remember that success in options trading doesn’t come overnight. It requires patience, diligent learning, steady practice, and a sound plan. Also, it's important to note that even with the right planning, there's still a possibility of loss and it's crucial to never invest money you can't afford to lose.

Lastly, keep abreast of factors that may impact your trading, such as market news, economic events, corporate announcements, and changes in market psychology. Knowing when to adjust your trading plan to these variables is key.

So, can you trade options for a living? Absolutely. Anyone disciplined, patient, and eager to learn can engage in this extraordinary form of trading. Although it requires hard work and preparation, the potential benefits are well worth the investment.

Remember, starting options trading is a journey, not a race. Taking the time to learn, practice, and understand what you're doing can significantly reduce your risk and increase your chances of success. Happy trading!

Return to Explain Options Trading Main Page

or

Go to Home Page

Your second block of text...

New! Comments

Have your say about what you just read! Leave me a comment in the box below.