Search Options Trading Mastery:

- Home

- Option Spread Trading

- Broken Wing Butterfly

Broken Wing Butterfly Options Trading Strategy

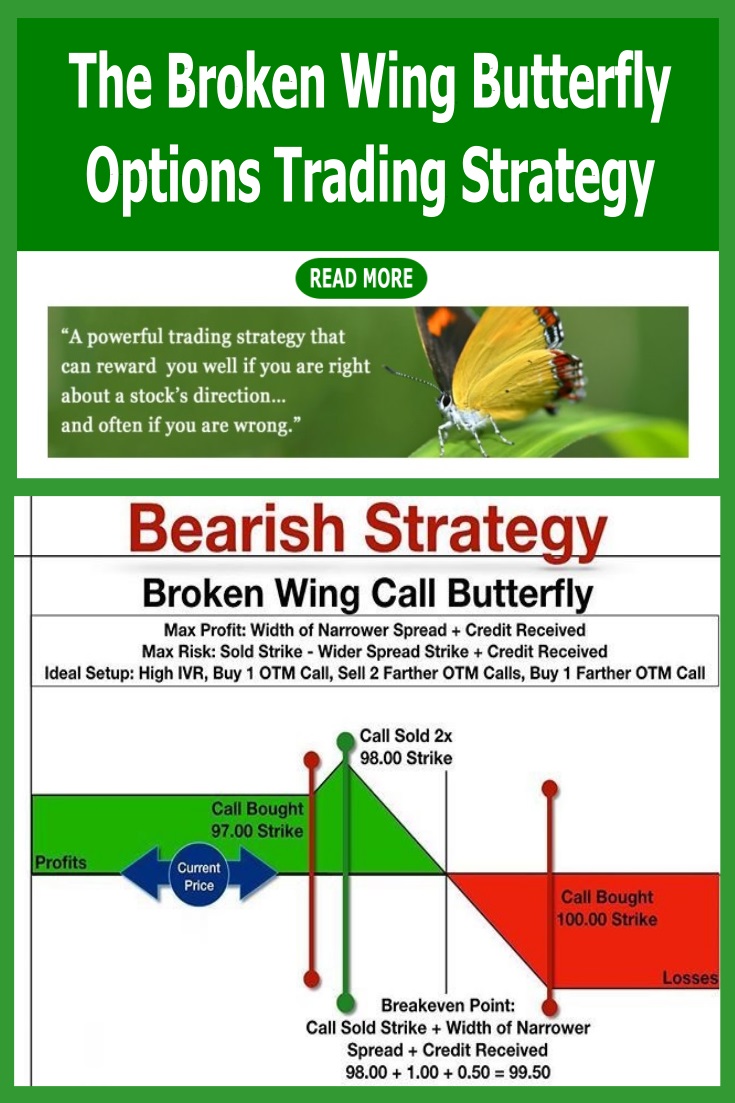

The Broken Wing Butterfly is a variation of the traditional butterfly option spread. The main difference in the setup of the trade is the choice of strike prices.

The difference in outcome is that you are guaranteed to make a small profit if the underlying price action goes one way, a much larger potential profit if it goes another way, but this, only up to a point after which you will realize a loss.

To explain, let's put it another way. If you believe the price of the underlying stock, commodity etc. is about to rise, you could of course simply buy a call option as a directional play. But if you're wrong and the underlying falls instead, your long call option position makes a loss.

So what if you could set up a trade where you would still make a profit if the underlying falls, make a huge profit if it rises according to your anticipations ... and only make a loss if it rises so dramatically that it breaks through a level which is quite far away from where it is today?

Would that appeal to you?

This is what you can do with a broken wing butterfly. It's important that when you structure it, you do it so that you receive an initial credit to your account.

This will be the "small profit" as mentioned above, should the price action go against you. The larger profit comes when the price action of the underlying moves in your favour.

The traditional butterfly spread is usually taken out with a debit to your account, but the advantage of the broken wing butterfly is that you start out with a credit. So it's important that you choose your strike prices and length of time to expiration carefully.

Broken Wing Butterfly - Worked Example

Let's illustrate how a broken wing butterfly is structured using put options on the SPY. At the time of writing, the SPY closed at 129.36 and we think it may fall further, but then again, it could rise instead.

So here's how we would set up our spread. All positions have 21 days to expiration.

- Buy 10 put options at 129 strike

- Sell 20 put options at 127 strike

- Buy 10 put options at 122 strike

You'll notice above, that the difference in strike prices between the closest to the money (129) options and the next strike price down (127), is only 2 whereas from 127 to 122 is 5 points (i.e. 500 points on the S&P500).

This is what constitutes the "broken wing" aspect of the butterfly. Unlike the traditional butterfly spread where the difference in all strike prices is equal, the broken wing butterfly contains this variation.

Now let's take a look at how our risk graph will look.

We can see how the trade will pan out during the next 21 days. If the price action goes against us and moves north, we will realize a profit of $200.

But if it goes south as anticipated, we move through a zone where our maximum profit could reach as high as $2,174 at expiration, down to a breakeven level of 124.80 which is close to 500 points from present price.

Below 124.80 we begin to realize a loss, up to a maximum $2,800 at below 122.

One thing to bear in mind with butterfly spreads whether traditional or broken, is that the potential profit does not open up until very close to expiration.

For this reason, you may wish to consider using this strategy with "weekly options" instead of monthly expiration dates.

The other issue is that your brokerage costs for entry and exit will be greater than for a single call or put option trade. It is a directional play and due to the short strike prices involved, will involve margin on your account, which will be equivalent to the maximum loss of $2,800 in this case.

Perhaps it has just occurred to you, that you can set up one of these spreads facing both ways?

If the trade is placed at the right strike prices, the strikes are spread apart correctly and the correct amount of time remaining until expiration is chosen, this kind of option setup is difficult to lose money with.

**************** ****************

Return to Option Spread Trading Contents Page

Go to Option Trading Homepage

Add a Comment

We and other readers of this information site value your input.

You can also (optionally) include any graphics such as charts, if you wish.

New! Comments

Have your say about what you just read! Leave me a comment in the box below.