Search Options Trading Mastery:

- Home

- Advanced Strategies

- Long Iron Butterfly

The Long Iron Butterfly - Credit Spreads on Steroids

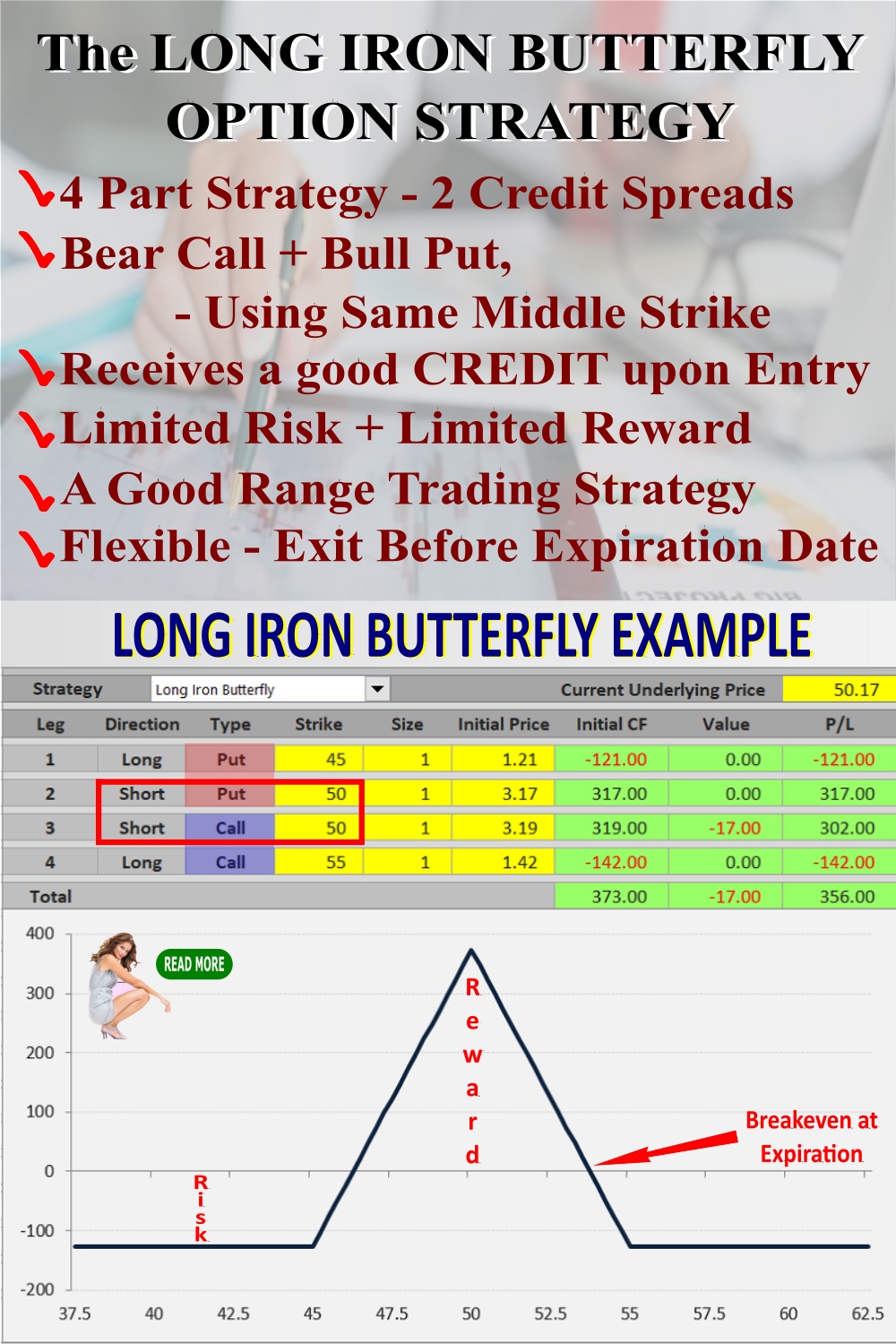

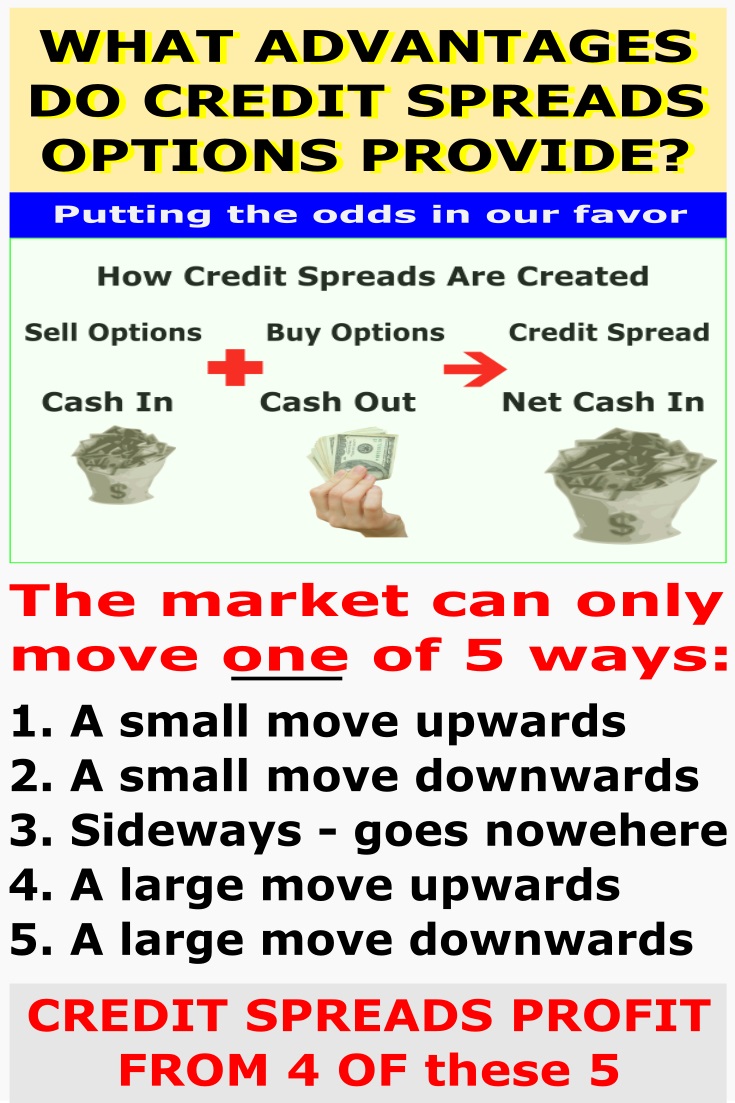

The long iron butterfly is a range trading option strategy and a variation of a similar option setup called the Iron Condor.

Both these strategies use a combination of two credit spreads which face in opposite directions - calls on the upside and puts on the downside.

The difference between the two is the range of option strike prices used.

The Iron Condor has four different strike prices and uses only 'out of the money' sold options for the 'body' of the setup.

The long Iron Butterfly on the other hand, focuses on using just one 'at the money' strike price, at which, both call and put options are sold (this is known as the "body" of the butterfly) and two 'out of the money' bought call and put options which are called the "wings".

As a consequence, the long Iron Butterfly brings in a greater credit in comparison to the Iron Condor and this is due to the higher priced ''at the money'' options that are being sold.

But it also involves a greater risk.

The

risk is, that the underlying stock price action will penetrate the

"wings" before expiration date. This is because the wings will usually

be closer to the current trading price of the underlying stock at the

time when you enter the positions.

Butterfly Spread vs the Long Iron Butterfly

We also need to distinguish between the concept of the long Iron Butterfly strategy and another one that is simply called the Butterfly Spread.

The regular Butterfly Spread consists entirely of either call or put options (but not both). If we were to break it down, we would notice that our Butterfly Spread is simply a credit spread and a debit spread that as far as strike prices go sit adjacent to each other. When you enter a 'regular' Butterfly Spread trade, you will usually see a net debit to your account.

The long Iron Butterfly on the other hand, uses two credit spreads - known as a 'bear call' and a 'bull put' spread respectively.

These two credit spreads are what creates the 'iron' part of this strategy. The idea is that you are receiving a double premium and a net credit in the knowledge that whatever happens from here, only ONE of the credit spreads can lose, if you let them run to expiration date.

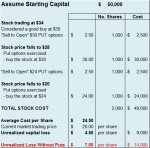

Let's look at a theoretical example to illustrate.

A stock is currently trading at $40. Therefore options with a $40 strike price will be "at the money". We believe this stock will continue to trade within the range of $35 - $45 up to the time our option positions expire.

We use the same number of option contracts for ALL positions and we'll assume that the options will expire next month. We're going to break our long Iron Butterfly spread into two segments:

1. The Bear Call Credit Spread Segment

SELL $40 'at the money' call options and BUY $45 'out of the money' call options 2. The Bull Put Credit Spread Segment

2. The Bull Put Credit Spread Segment

SELL $40 'at the money' put options and BUY $35 'out of the money' put options.

From the above we can see that we have taken four options positions simultaneously, with a common "at the money" $40 strike price for calls and puts, to form our long Iron Butterfly - but breaking it down, we have two credit spreads.

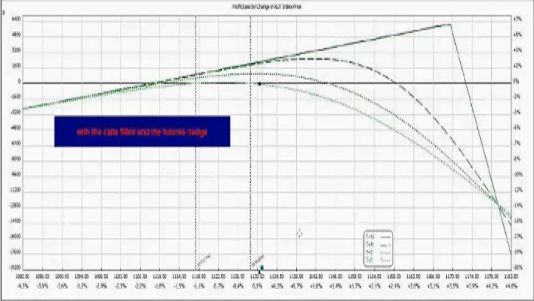

Characteristics of the Long Iron Butterfly Spread

Limited Risk: Your risk is the difference between ONE of the strike prices on either side of the middle strike prices, (the 'body' of the butterfly), LESS the premium you have received from selling both 'at the; money' call and put options. If option volatility is working in our favor at the time we take the trade, this risk can be minimal.

Limited Reward: Profit is limited to the premium received from selling 'at the money' options.

Margin Required: Normally for credit spreads, you will need sufficient funds in your trading account to cover the difference between strike prices, times the number of shares the option contracts cover.

However, since it is only possible for one of your positions to be in a loss situation at option expiration date, most good options brokers will take this into consideration and only require a margin necessary to cover one side of the spread.

Recommended Strategy

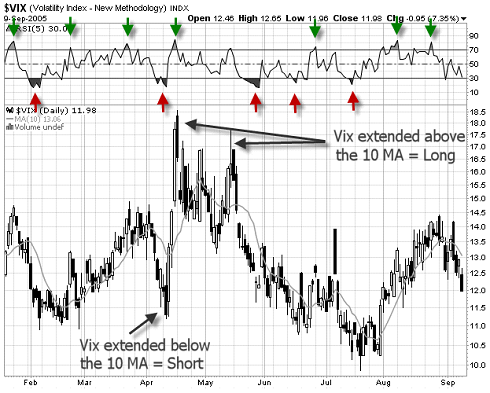

First, you identify a stock that you believe will be range

bound at least until the expiration date of your long iron butterfly

position. Looking at monthly price charts can give you a clearer picture in this regard.

Second, you should examine the current market prices relative to the option strikes necessary to establish the strategy. Organize these into a table and evaluate the 'risk to reward' ratio before placing the trade.

The basic idea is, to take advantage of option prices that will allow you to get into the trade for a maximum credit in comparison to the potential maximum loss at expiration.

For example, if you see a long Iron Butterfly opportunity following a large price move in the underlying, option implied volatility may work in your favor so that your sold positions relative to your out of the money bought ones result in a risk to reward ratio of over 1000 percent.

Exit Strategies

You do not need to wait until option expiration date to exit your position. Providing the underlying stock remains within the range you anticipate, this allows you some flexibility as the options approach expiration date.

You simply evaluate the profit level within the final two weeks before expiration and exit when the market price of the underlying is closest to your 'at the money' positions.

However, if the price of the underlying should surge away in either direction and breach the outer strike prices, you can do one of two things.

Either exit the position to ensure you are not assigned the underlying shares, or ... depending on where you think the price action of the underlying may go from here, you could take advantage of a nice characteristic of credit spreads and roll out the losing position to a later expiration month, while letting the other side of the credit spread expire without risk.

**************** ****************

Return to Option Trading Strategies

Return to Option Trading Homepage

New! Comments

Have your say about what you just read! Leave me a comment in the box below.